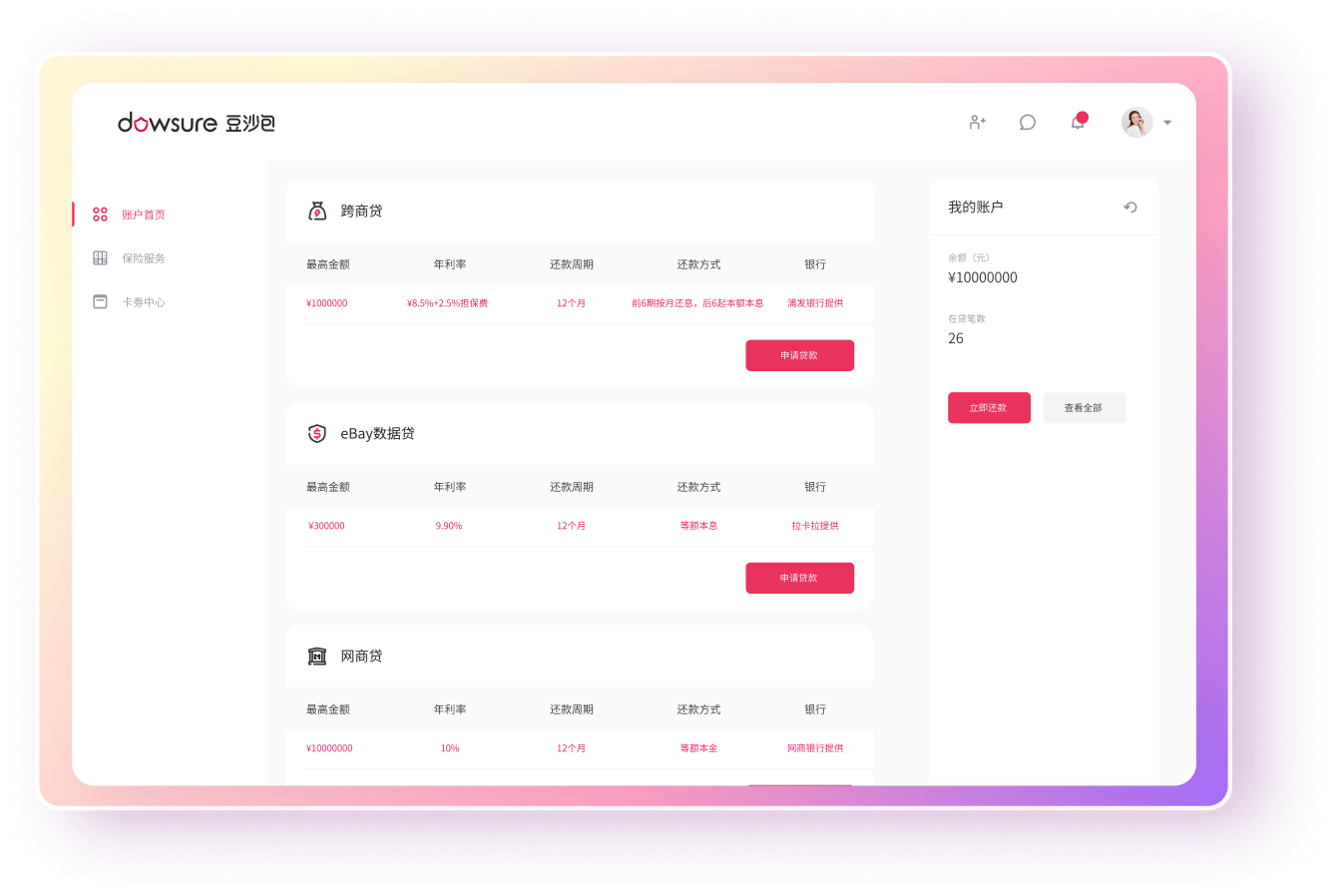

What is the Financial Cloud?

A one-stop SaaS service of cross-border e-commerce finance for financial institutions, including a series of full-process cloud services to assist in customer acquisition, data, modeling, and account dual-locking.

Description of Functions

Traffic Push API

The platform uses Dowsure's pre-screening model to accurately recommend personalized financial services to sellers based on the seller's performance, to lower the financing threshold for sellers.

D-Shield API

A complete set of D-Shield Open API for cooperative financial institutions to help them actualize completely closed-loop control of fund flow.

Platform data API

With seller's authorization, the platform will provide Dowsure with comprehensive and accurate store operation data as data sources for the machine learning model, in order to obtain credit support from financial institutions.

Post-loan monitoring data modeling

A complete set of post-loan monitoring + data model Open API for cooperative financial institutions to help them gain insights on real-time observation and early warning of irregularities in the operation data of sellers’ stores;

Management BOSS System

Cooperative financial institutions can use this system to manage user loan data and repayment data and operate comprehensive functions, such as statistical analysis of store operation models, store overall rating, real-time observation of loan data, and configuration of early warning rules on operational irregularities;

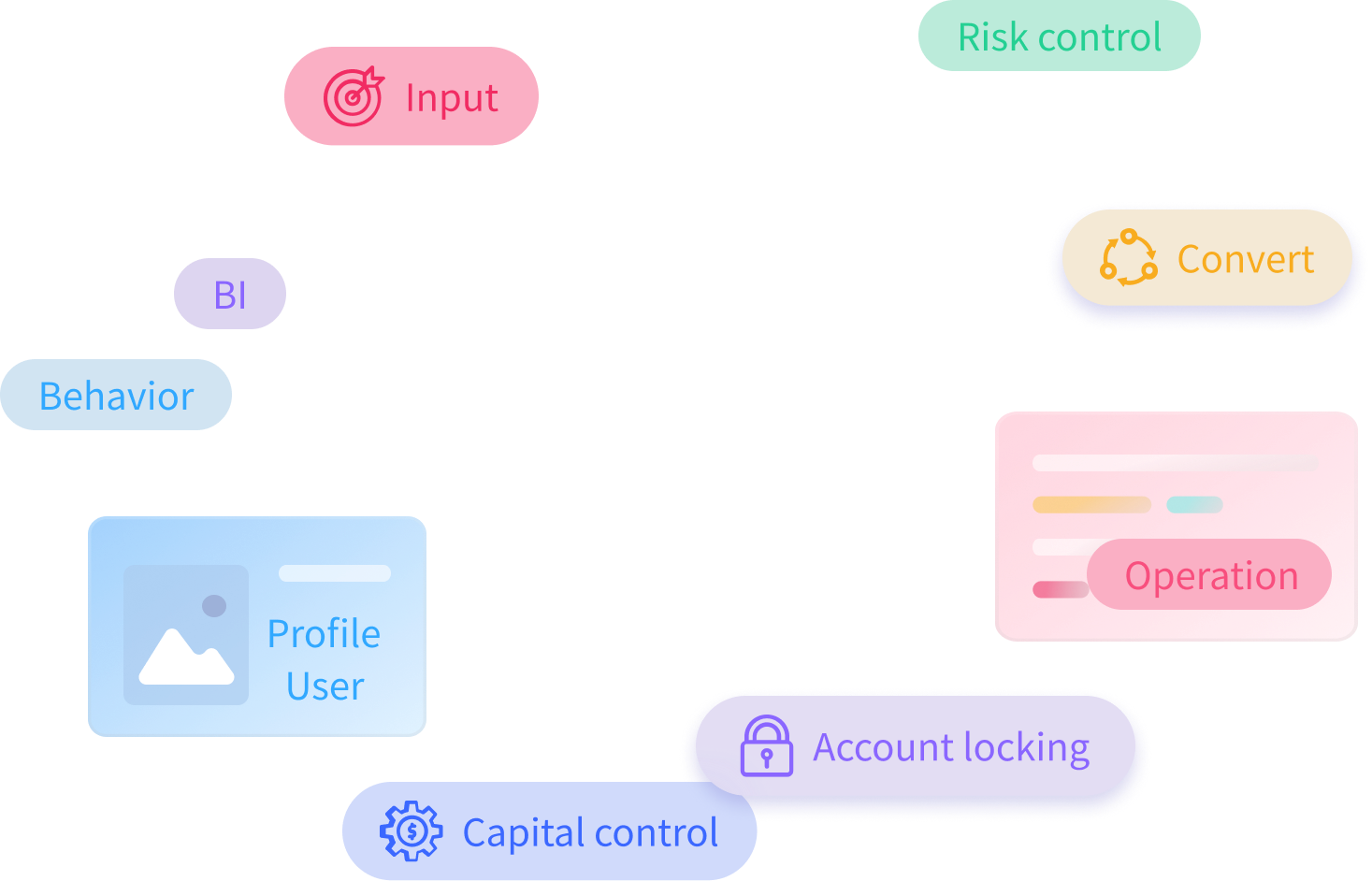

Product Advantage

Partnership

Based on Dowsure's official partnerships with Amazon, eBay, and Shopee, after granting access to store data, sellers can actualize store assessment and risk identification with the smart risk control model of the insurance, in order to generate a one-stop solution for sellers and cooperative agencies.

Data Advantage

E-commerce platform authorized data, real compliance, a number of financial institutions have adopted the store operating data model.

Risk Control

full-process capital control capabilities, realize the entire ecological closed loop, API integration output.

Operational Advantages

Repayment collection (cross-border repayment + cross-border credit lending) is supported by rich experience in operation, including accurate traffic distribution, receiving account confirmation/switching, KYC/KYB information verification, product design consultation, etc.

Partners

Feedback

-

SPDB

- MYbank

SPDB

Product used

Dowsure Cross-border Financial Cloud

Problem

SPDB adheres to the core values of “honesty, integrity, and excellence” and has been committed to providing a series of professional-client comprehensive financial service solutions for clients such as small and medium enterprises and private banks.

Having observed the rapid development trend of cross-border e-commerce in recent years and huge customer demand, the bank hoped to quickly make its products available in this multi-billion market.

Solution

MYbank

Product used

Dowsure Cross-border Financial Cloud

Problem

MYbank adheres to the brand philosophy of “Being meticulous” and is committed to solving the financial needs of small and medium entities. MYbank provides completely online financial services for more small and medium businesses.

MYbank has always insisted on using leading technologies as its development engine and hopes to help the multi-billion cross-border e-commerce market to develop more comprehensively through its digital capabilities.

Solution

Through the cooperation with Dowsure and with the help of Dowsure Cross-border Financial Cloud, MYbank successfully launched the cross-border seller product MYbank | MYbank Loan. The product supports online application and offline review and approval, providing cross-border sellers a purely credit-based loan with no collateral required. It efficiently and conveniently assists cross-border merchants to achieve smooth fund turnover.

SPDB

Product used

Dowsure Cross-border Financial Cloud

Problem

SPDB adheres to the core values of “honesty, integrity, and excellence” and has been committed to providing a series of professional-client comprehensive financial service solutions for clients such as small and medium enterprises and private banks.

Having observed the rapid development trend of cross-border e-commerce in recent years and huge customer demand, the bank hoped to quickly make its products available in this multi-billion market.

Solution

MYbank

Product used

Dowsure Cross-border Financial Cloud

Problem

MYbank adheres to the brand philosophy of “Being meticulous” and is committed to solving the financial needs of small and medium entities. MYbank provides completely online financial services for more small and medium businesses.

MYbank has always insisted on using leading technologies as its development engine and hopes to help the multi-billion cross-border e-commerce market to develop more comprehensively through its digital capabilities.

Solution

Through the cooperation with Dowsure and with the help of Dowsure Cross-border Financial Cloud, MYbank successfully launched the cross-border seller product MYbank | MYbank Loan. The product supports online application and offline review and approval, providing cross-border sellers a purely credit-based loan with no collateral required. It efficiently and conveniently assists cross-border merchants to achieve smooth fund turnover.